Transportation insurance specialist Kevin Rettberg recently joined Breckenridge to lead an established team of professionals previously operating under the name…

Read Article

Transportation insurance specialist Kevin Rettberg recently joined Breckenridge to lead an established team of professionals previously operating under the name…

Read Article

Congrats to Breckenridge’s Victoria Dearing, AAI, CPCU, RPLU, ARM-P on being one of The Best Professional Liability Insurance Brokers, 5-Star Award Winners…

Read Article

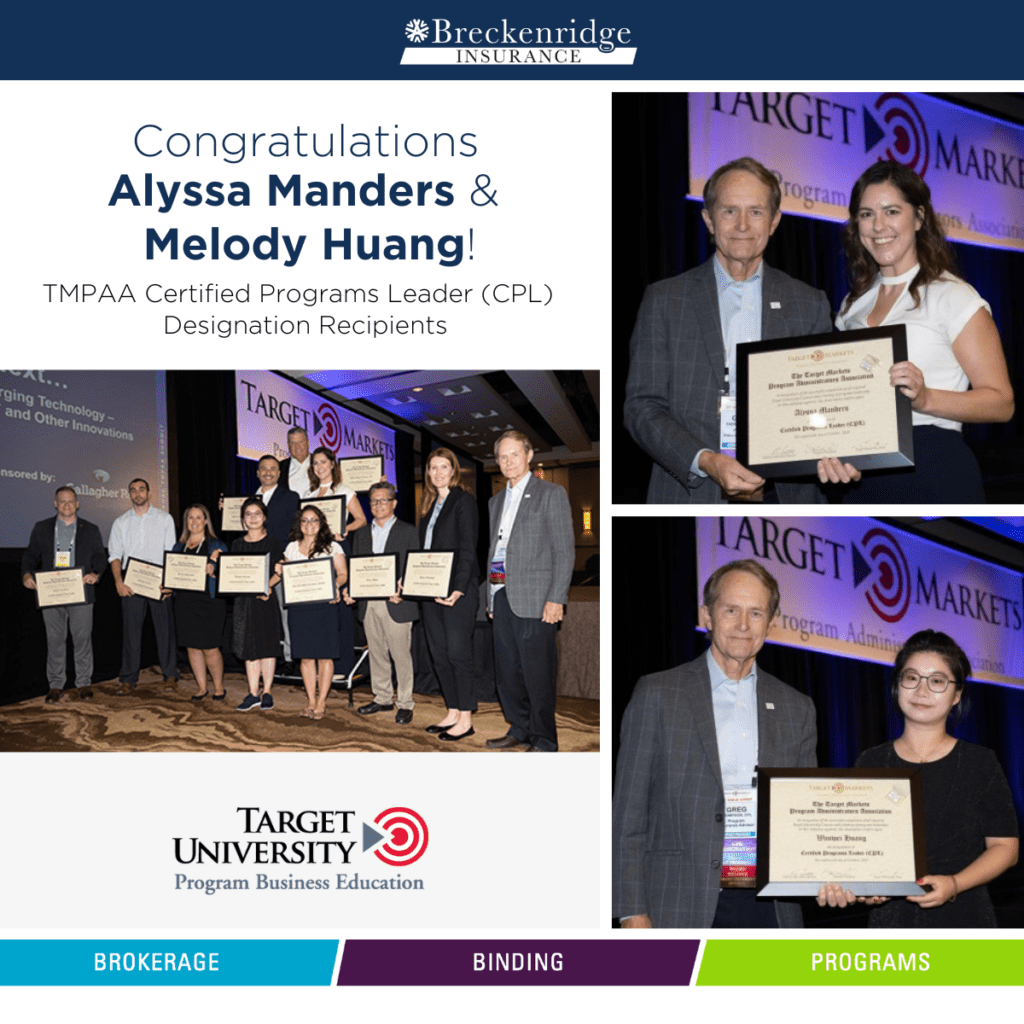

Congratulations to Alyssa Manders and Melody Huang on recently receiving their Certified Programs Leader (CPL) designations from the Target Markets…

Read Article

Protect your insureds from unforeseen legal actions and financial hardship or ruin because of alleged errors or omissions. This exclusive…

Read Article

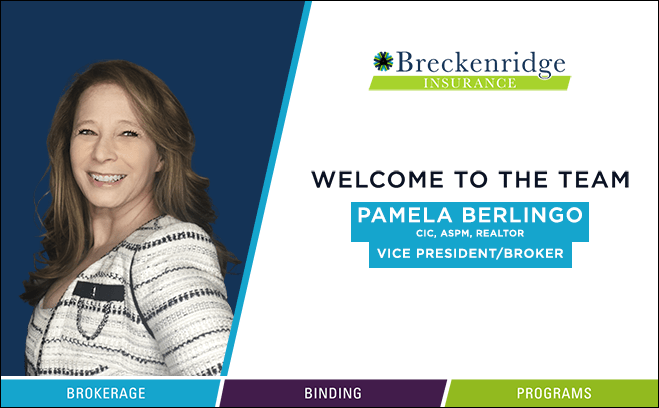

Please join us in welcoming Pamela Berlingo to Breckenridge Insurance as a VP-Broker! In this role, Pamela works diligently with…

Read Article

ATLANTA, Ga., June 1, 2023 — Breckenridge IS, Inc., a diversified insurance distribution and services firm, today announced the sale…

Read Article

We are pleased to announce that Binh Nguyen Farris has been promoted to Broker at Breckenridge Insurance! As a part…

Read Article

Breckenridge Insurance is proud to announce that Victoria Dearing, AAI, CPCU, RPLU, ARM-P, SVP of Professional Liability and Risk Management,…

Read Article

We are excited to announce that the Bowling for Charity Bash raised $2,400 for the featured charities – Victory Service…

Read Article

We are excited to share that Breckenridge Group is a proud gold meeting sponsor of the Target Markets Program Administrators…

Read Article